Share price development part 1: and suddenly so much confidence.

A shareholder is just a (co-)owner of a company. He owns a share of the profits resulting from the business activity. Accordingly, the ratio of share price to profit, the price-earnings ratio (PE ratio), is a key factor in assessing the attractiveness of an investment. If the price of the share is low and at the same time the profit is high, the share has a low and therefore attractive price-earnings ratio.

The price-earnings ratio is calculated on the basis of current earnings. Of course, future earnings are at least as relevant and a higher P/E ratio can be well justified by higher expected earnings growth. In this context, analysts speak of the PEG ratio (price-earnings-to-growth ratio): the price-earnings ratio in relation to expected medium-term earnings growth. If the PEG ratio is below one, a stock is considered attractive; the higher the value, the less attractive the investment. If the PEG ratio is twenty, then there would have to be at least medium to long-term earnings growth of 20% for the stock to be considered clearly attractive; the average earnings growth for NVIDIA in this simple analysis would therefore currently have to be around 230%.

This correlation between valuation and expected growth is also evident when looking at different markets. For example, the U.S. stock market has had an average price/earnings ratio of 20 over the last ten years, while German stocks have had one of 15 – due to the structurally lower average growth of (listed) German companies. Expressed in terms of P/E ratios, the European markets are therefore only supposedly cheaper; the higher average growth of the US market allows for a higher P/E ratio without having to speak of a more expensive market.

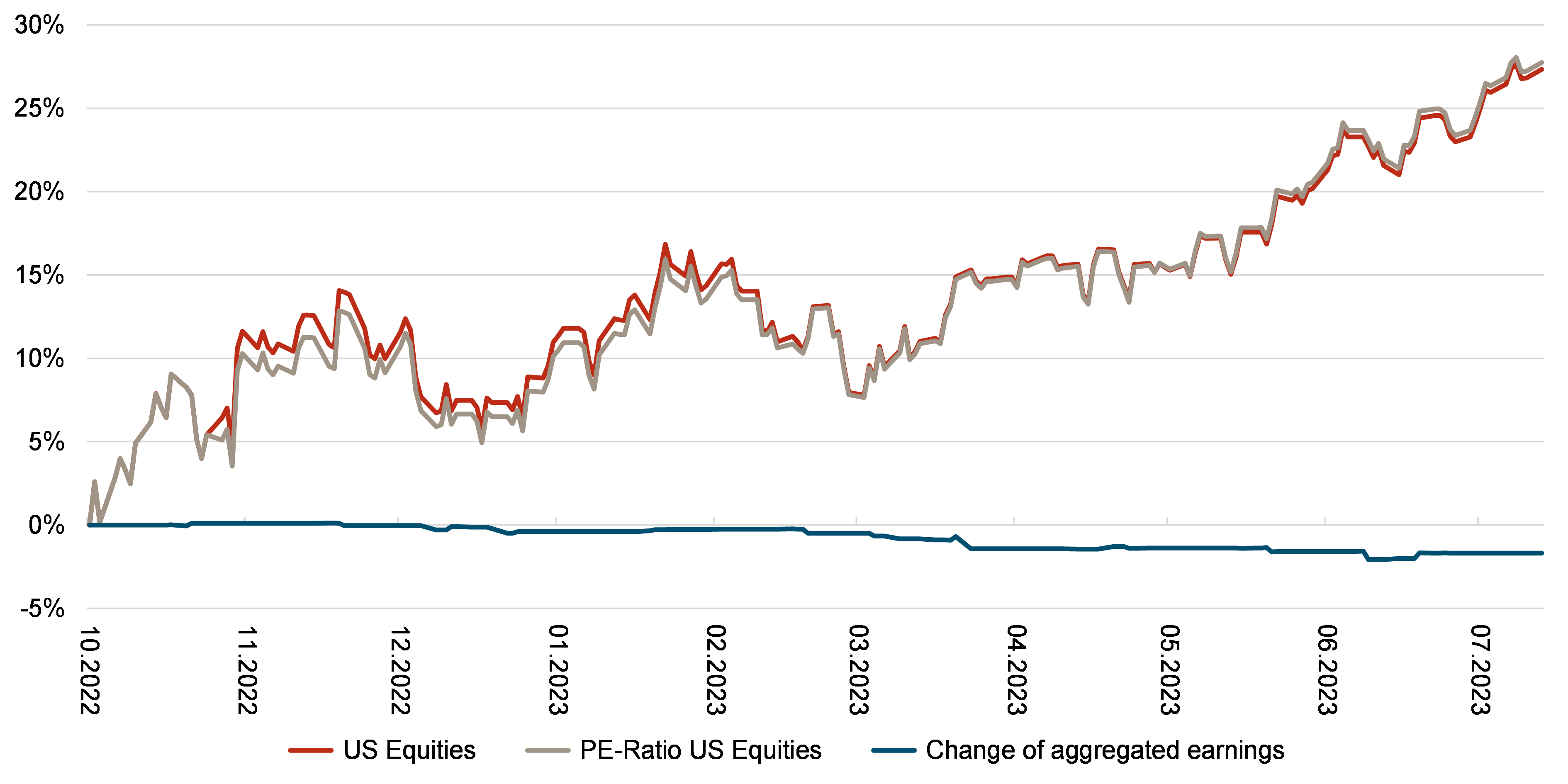

If we look at the development of the P/E ratio for U.S. equities since the low in mid-October 2022, we see a change from 17 to the current 22. The more than 25% increase in share prices since last fall is thus exclusively attributable to an expansion of the valuation. The cumulative earnings even show a decline. The current higher P/E ratio must therefore be motivated by more optimistic growth forecasts.

The considerations on the revision of interest rate expectations set out in the CIO Letter of June 26 have contributed to the widening of the P/E ratio. However, the question remains whether such strong growth can really be expected compared with October of last year – if this is not the case, it is certainly fair to speak of expensive markets. This is true even if the current value of 22 is still within the historical range – the potential for negative surprises has increased.