Gold and Bitcoin: Still a Valuable Addition to Your Portfolio?

As explained in the last blog, both gold and Bitcoin are currently reaching new price highs – despite the fact that neither asset is yielding any returns, and the current interest rate level is certainly a headwind for non-yielding assets. Nevertheless, the prices of gold and Bitcoin – sometimes referred to as ‘digital gold’ – continue to rise. Is an investment worthwhile even if there is no yield?

Firstly, investors are not interested in why prices are rising. However, the argument for a long-term positive price trend becomes less convincing without a yield component. Therefore, examining the correlation between these assets and the rest of the portfolio is crucial. If a positive correlation shows added value for the portfolio, there may be an argument for an addition. The price fluctuations themselves – definitely not for the faint-hearted in the case of bitcoins – can also turn into a pro argument.

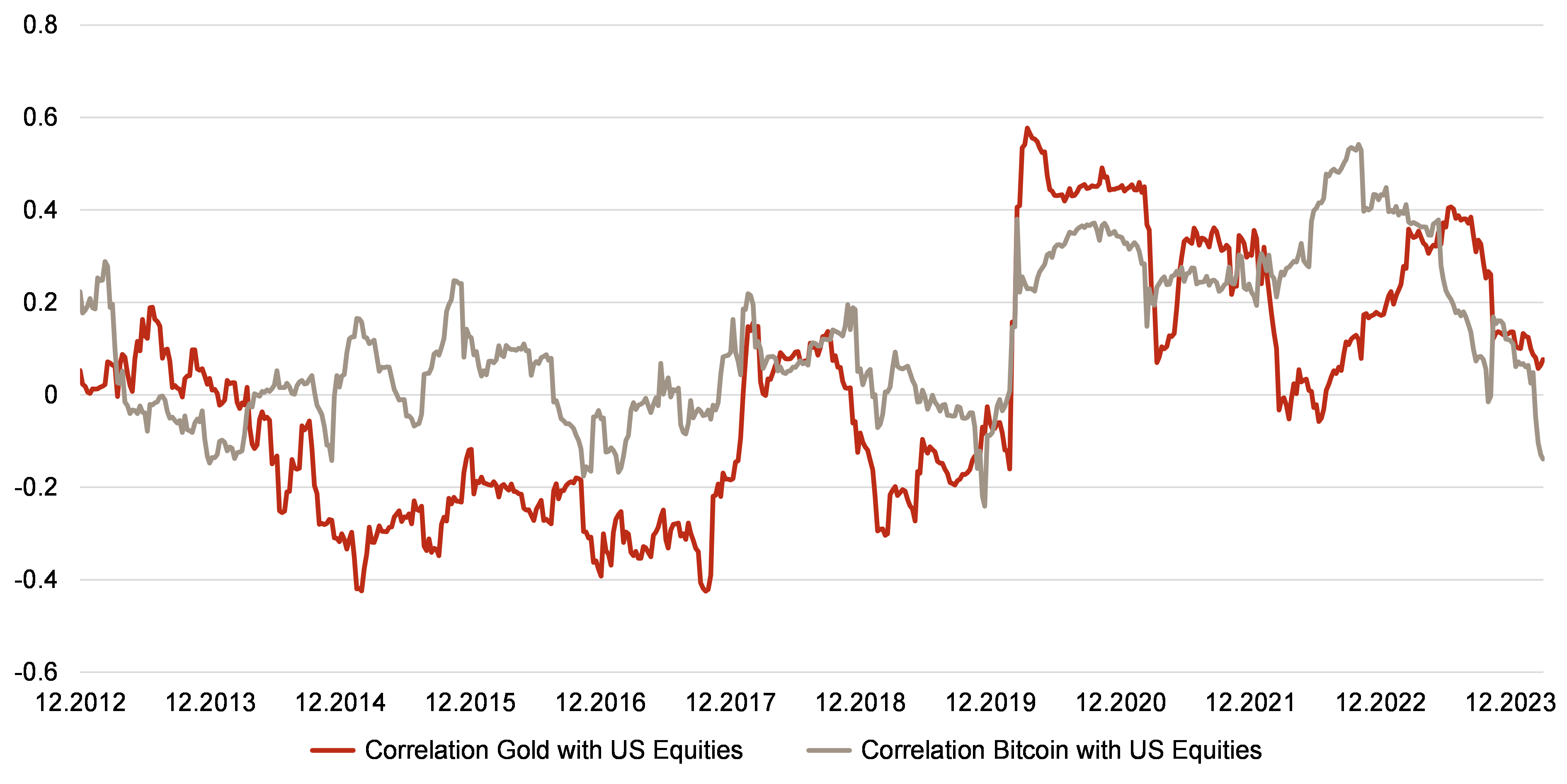

If we look at the correlation between gold and Bitcoin and US equities, we can indeed see that it has been low over the last ten years, averaging 0.0 for gold and 0.1 for Bitcoin. Values above zero signal a certain synchronization of prices; a diversification and thus risk reduction effect can be observed with all correlation values below 1 – this corresponds to a perfect synchronization of prices. Values of less than 0.3 already signal a very high diversification and thus risk reduction potential. If there is also a high level of volatility, even a small addition can help to stabilize the performance of the overall portfolio in the long term.

Even without a yield component, the finite supply of gold and Bitcoin, coupled with sustained demand, suggests a potential for long-term price increases. The correlation properties then speak all the more for an addition to the portfolio – and the possibly high volatility is not a valid counterargument…