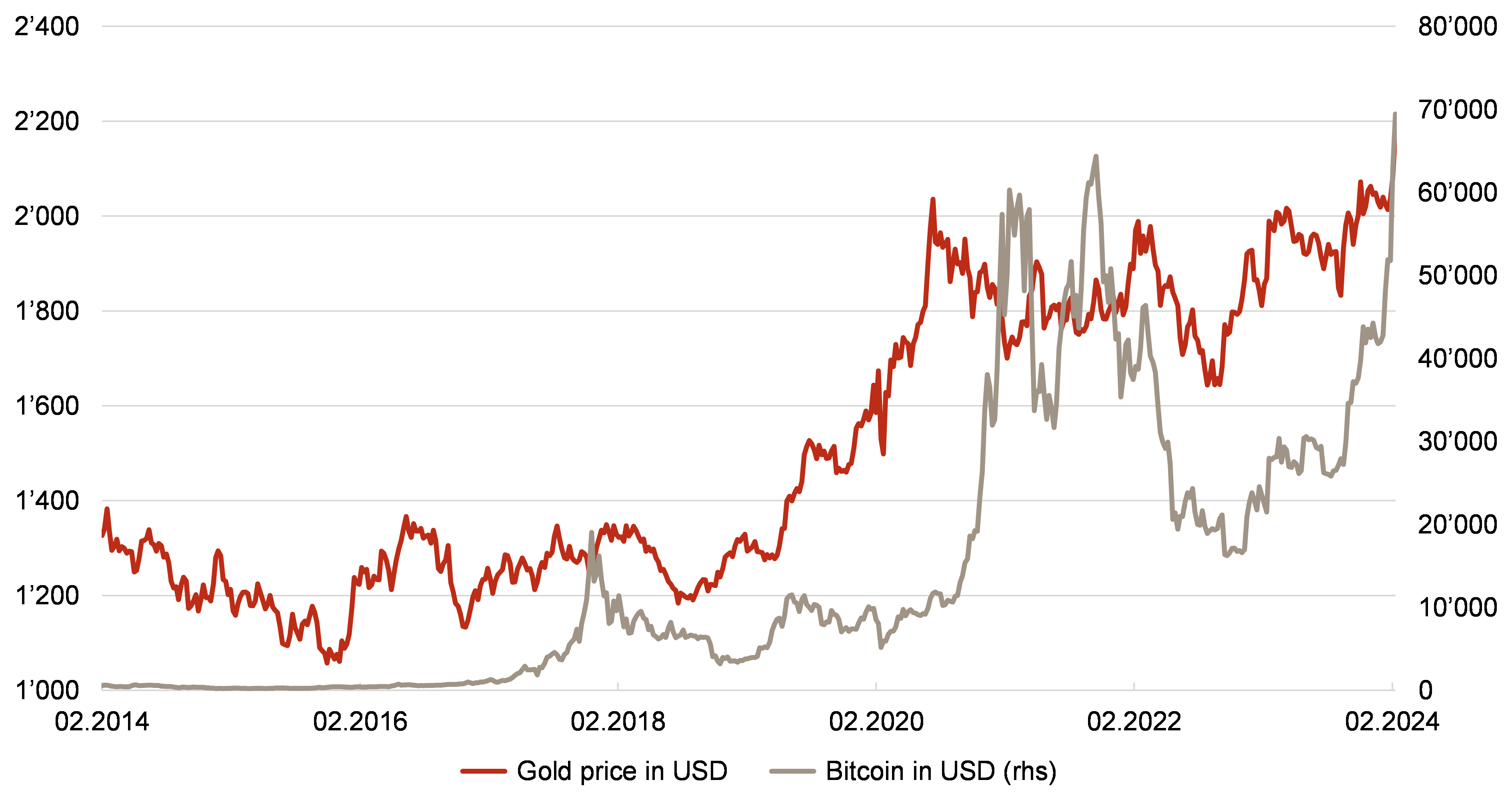

Gold and Bitcoin: here we go again.

In the shadow of new record highs on the stock markets, the prices of gold and bitcoin have climbed to new highs. This is surprising as, with positive interest rates, investments without a yield component – such as gold or Bitcoin – should be facing headwinds. How can it be that both have reached new price highs these days?

One of the main reasons lies in a process that could also be called gradual “de-dollarization”. Gold as well as Bitcoin can be seen as alternatives to the dollar, and a move by major buyers away from the USD as the reserve currency leads to rising demand for these alternatives – and thus rising prices.

What are the reasons for this dollar skepticism? Three main causes can be cited:

- Debt: The US national debt has reached new highs and with a doubling of the national debt over the last ten years, a debt burden of over 130% of the US gross domestic product, significantly increased interest rates and a short remaining debt maturity – one third of the total national debt must be refinanced by 2025 – the USD is subject to far-reaching structural problems.

- Political uncertainties: There are some geopolitical risks associated with the upcoming US presidential elections in November this year. The further course of the USA’s international orientation will depend to a large extent on the outcome of the elections and the associated uncertainty is causing various market participants to look for alternatives to the USD.

- Sanctions: As a global reserve currency, the USD has been used time and again to sanction and (supposedly) discipline actors and countries. Most recently, for example, as a result of the escalation in the Russia-Ukraine conflict, USD assets were frozen and elements to be sanctioned were excluded from the USD payment system. As a result, countries such as China – potentially fearing similar sanctions – are also turning away from the USD in favor of alternatives; the rising price of gold in particular can be attributed to a significant increase in demand from China.

Although neither gold nor Bitcoin yield a return, the demand for alternatives to the USD remains and this demand is driving prices. In the shadow of the good performance on the stock markets, the price development of gold and Bitcoin can also be seen as a warning signal. In the past, gold at least has repeatedly served as a safe haven during geopolitical upheavals.