Investments in gold part 1: despite the rise in interest rates?

Looking at investment strategies as well as portfolios, gold often appears as a component. This is somewhat special – all the more so as gold is not an asset class in the true sense of the word, since there is no yield.

Explanations for the use of gold are manifold: The price of gold often moves somewhat independently of the prices of traditional investments such as stocks and bonds, which gives an investment in gold a certain diversification advantage. Furthermore, gold is often seen as a hedge against inflation, as the price moves independently of currencies and reflects the intrinsic value of the precious metal – a value that has also held up historically.

Despite these empirically verifiable properties, gold has one important disadvantage: it does not yield any return. The higher the interest rates, the greater the opportunity costs: Money invested in gold cannot be invested in securities that yield a return.

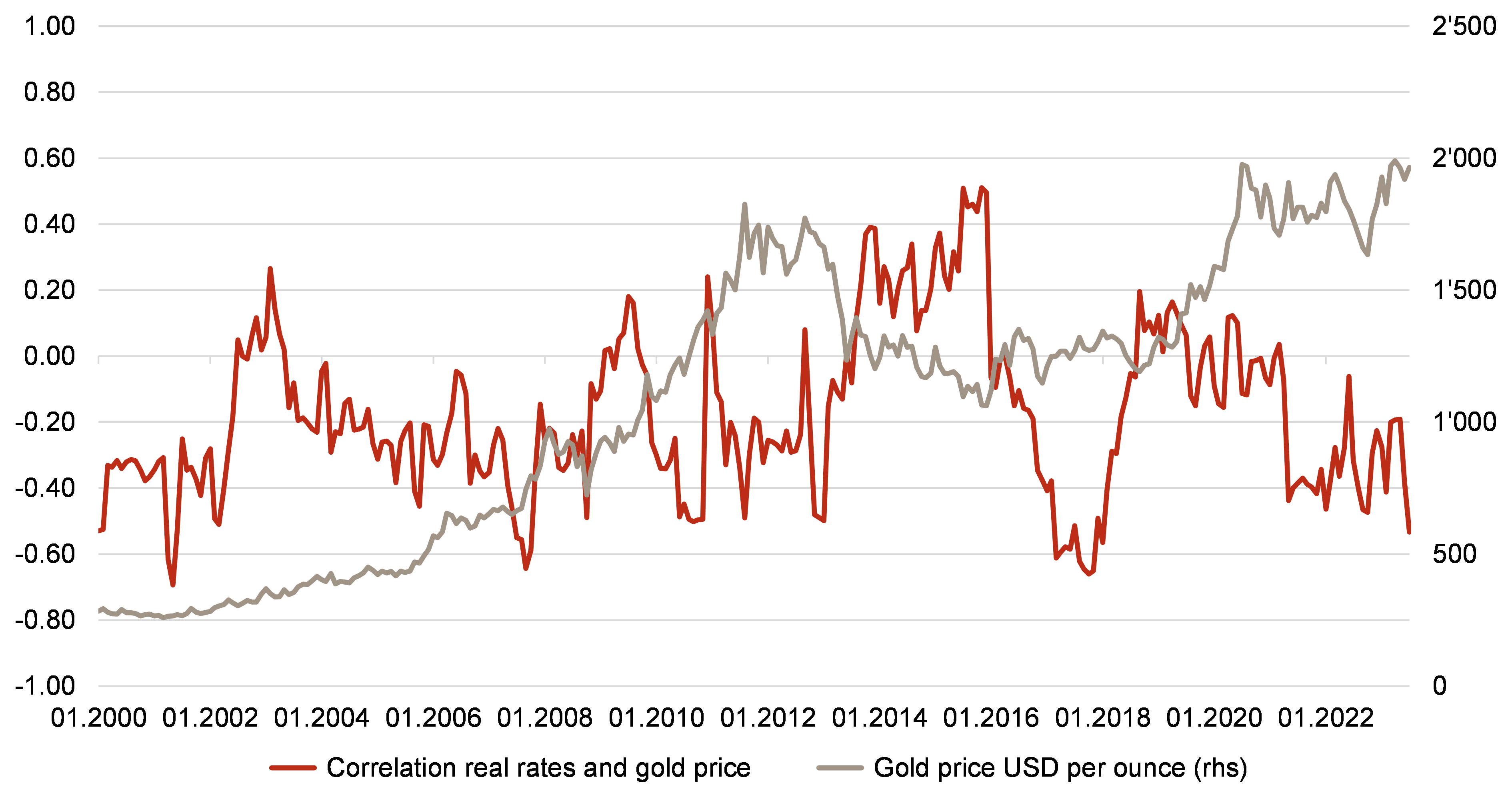

This logic results in a simple correlation: If interest rates rise, the price of gold should actually get under pressure. Nevertheless, the gold price has held up surprisingly well in the last months of rising interest rates… Since the first interest rate step by the US Fed in March 2022, the gold price has even increased slightly.

However, if we look at the relevant real interest rates – i.e. the nominal interest rate level adjusted for current inflation – this negative correlation becomes apparent: Due to the jump in inflation, the real interest rate has fallen in recent months, which is consistent with the rise in the gold price. Assuming that inflation continues to decline and that interest rates do not fall at the same time, the scope for a further rise in the gold price should therefore be very limited and setbacks would not be surprising.