Equity markets in the first quarter: better than expected?

Contrary to the expectations of most market analysts, the stock markets closed the first quarter of 2023 very favorably. All relevant stock markets showed gains. The world equity index shows a performance in the first three months of 2023 of over 7%. If this is placed in the context of the last 50 years, this market development is clearly in the first quartile. Against the backdrop of ongoing interest rate hikes and fears regarding a possible hard landing – a recession – this start into the year has surprised most market observers. But was the first quarter really that appealing?

To answer this question, a look behind the numbers of the overall market development is necessary. Where does the development come from? Is it broad-based or perhaps simply due to individual sectors or even individual stocks?

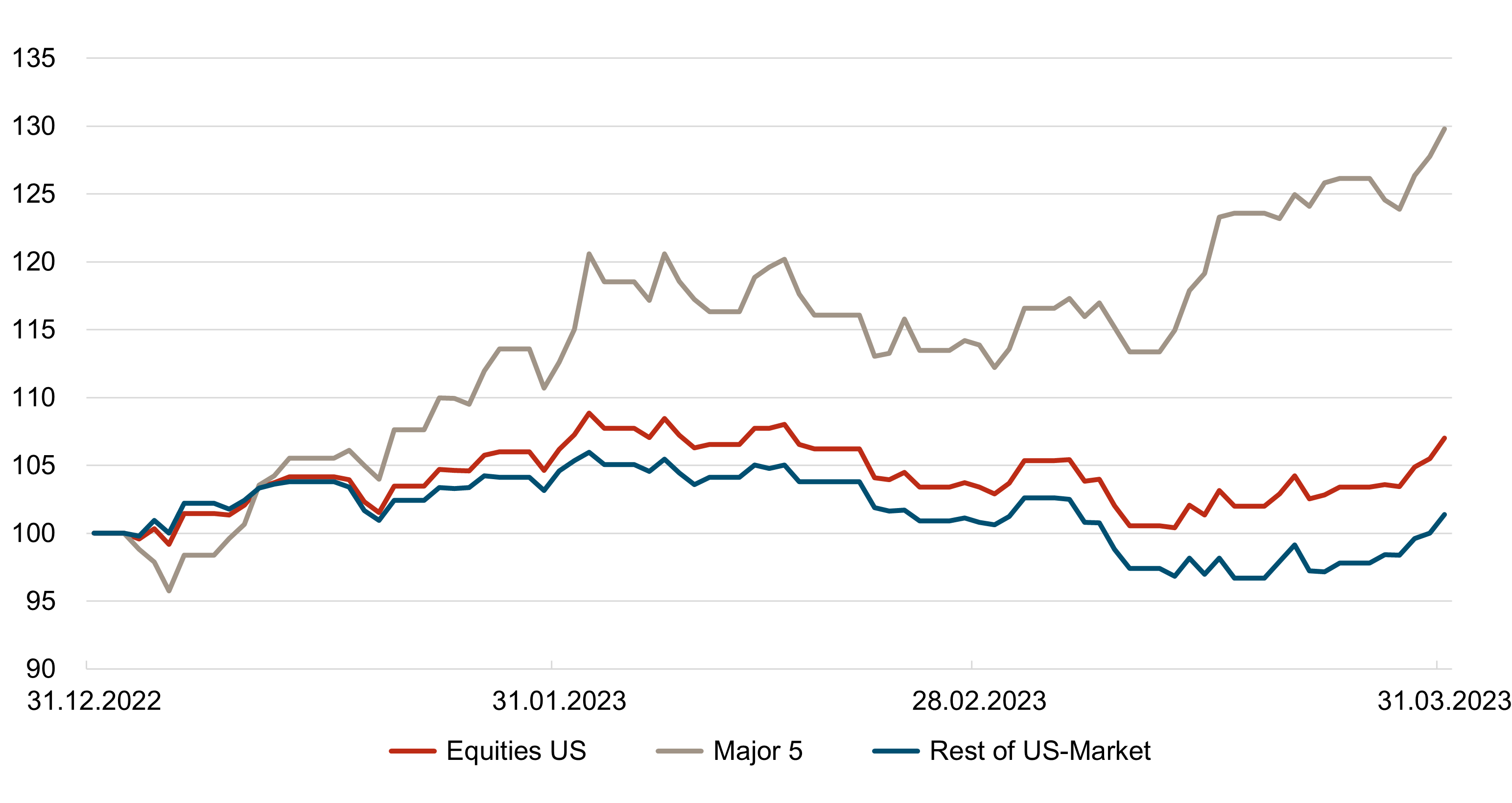

If one performs such an analysis for the most important stock market, an interesting picture emerges: the US stock market closed the first quarter of 2023 with a plus of 7.03% – the largest five stocks in this market closed the quarter with a performance of between +18% (Alphabet) and +90% (NVDIA). If one further considers that these five large stocks account for almost 20% of the total market, it quickly becomes clear that the positive market performance is not broadly driven but rather due to specific stocks.

If we exclude the performance of the five largest stocks from the overall market, we see that the rest of the market shows a marginal performance of just 1.4% for the first quarter. In contrast, the market-weighted performance of the largest stocks is shy of 30%.

Even though the first quarter was much better for the stock markets than generally expected, a closer look shows that the development is strongly driven by only a few stocks. These are primarily positions from the technology sector – stocks that are often more interest rate sensitive due to their growth prospects and earnings that are usually further in the future. And market participants’ expectations regarding future interest rate developments have weakened significantly in recent weeks. Currently, the first interest rate cuts are expected before the end of the year due to falling inflation and the emerging threat of recession.

Stock markets are not showing a positive development due to a constructive economic outlook; rather, a few interest rate-sensitive stocks are benefiting excessively from the expectation of falling interest rates – so the stock market development in the first quarter should not be seen as unconditionally positive after all.