Dividend stocks: has “TINA” left us?

With more or usually less creativity, the financial industry regularly invents acronyms to explain the current market situation. “TINA”, stands for “there is no alternative” and has repeatedly kept the markets busy in recent years.

This alleged lack of alternatives meant nothing other than that, due to the prevailing low interest rates, there were no real alternatives to investing in equities. If interest-bearing securities could no longer generate a return, equity investments would inevitably have to be considered.

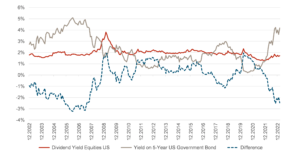

To compare the attractiveness of bonds and equity investments, the difference between the dividend yield on equities and the current yield on interest-bearing securities is often calculated. If this value is positive, stocks yield more through dividends than bonds do through coupons. Accordingly, equities should be more attractive. This relationship is also known as the FED model.

There are two problematic aspects to this approach:

- The focus on dividend yields leads, as outlined in a previous blog article, to unbalanced portfolios with potentially significantly different return and risk characteristics.

- Focusing solely on the difference between dividend and coupon levels ignores the fact that the resulting portfolios differ significantly in their risk level – equities are not risk-free bonds, but higher risks also entail higher return potential.

If we look at the development of the various yields over the last twenty years, we note that between 2008 and the middle of last year, the dividend yield on equities was mostly higher than the yield on 5-year bonds – equities were supposedly more attractive and, since interest rates were close to zero anyway, there was no alternative. The reasons for this situation can be found in the extremely expansive monetary policy pursued over the years. After the financial crisis of 2008, interest rates were pushed down to historically low levels through various central bank programs. At the same time, companies began to increase dividends, some of which were even financed with debt due to the low interest rates.

With the normalization of the monetary policy over the past few months, the picture has changed rapidly. Currently, the yield on the 5-year US government bond is over 4%, while the dividend yield on US equities is below 2%. With a difference of over 2%, bonds are thus yielding significantly higher than equities and, in both relative and absolute terms, at their highest level since the end of 2007. For Swiss equities, the dividend yield of just under 3% is currently (still?) above the level of the bond yield – but here, too, the difference is lower than it has been since the end of 2010.

With higher interest rates and the development of yield spreads, it must be concluded that “TINA” has indeed passed on. In both absolute and relative terms, bonds have gained significant ground over equities in recent months and represent a viable alternative. “TINA” RIP; “bonds are back” or “BAB”. It won’t get more creative.